By Sammi Sontag

INWEEKLY

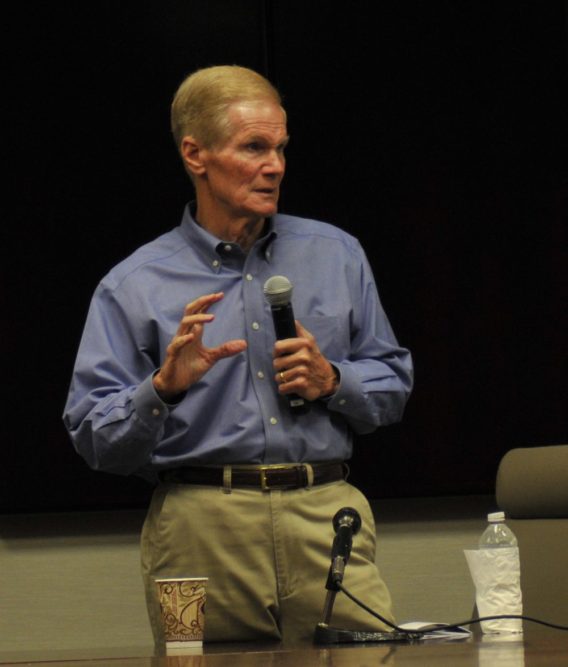

U.S. Senator Bill Nelson (D-FL) visited the University of West Florida and met with graduates to discuss the Student Loan Relief Act, which is legislation aimed at cutting student loan interest rates and allowing borrowers with existing student loans to refinance to the lower rates.

Nelson has visited a number of different universities throughout Florida and will continue to meet students in order to share their stories with his colleagues to push this legislation through Congress.

“What we need is an educated work force,†Nelson said. “Our ability to stay competitive globally is going to be by our ingenuity and creativity and in order to do that we got to have an educated work force.â€

He said the second largest debt in America, only behind mortgage debt, is student loans; this debt totals to almost $1.3 trillion.

On July 1, federal student loan interest rates for undergraduate students increased from 3.76 percent to 4.45 percent. The senator said this continual increase hurts a number of students after college.

“The loan interest rates for undergraduates can go all the way up to 8.5 percent, that’s a cap,†Nelson said. “But for graduate students it can go all the way up to 10. So what I would try to do is cap it at 4 (undergraduate students), 5 (graduate students) and 6 percent for parents.â€

On the Senate floor earlier this week, Nelson said “Capping interest rates, ending loan origination fees and allowing borrowers to refinance existing student loans would certainly help make education more affordable for our students and it would help ease the financial stress that’s weighing down our economy.â€

Some currently have paid internships and work part-time jobs in order to pay back their student loans, while others will work for ten years to have their loans forgiven. No matter the circumstance, it will take each of these students and others like them time to pay back their acquired debt, Nelson said.

Erin Percifull was one of the students who attended the discussion. She did not have student loans coming out of undergraduate school, but furthering her education came at a high price. Percifull incurred $80,000 of debt earning her master’s degree.

“I received my masters from Columbia University,†Percifull said. “My debt is a combination of different student loans. And right now with interest rates the way they are I’m hardly making a dent in my principal.â€

She said the interest rates on her loans range from 5 to 7 percent with the highest at 7.2 percent. With Nelson’s proposed legislation, Percifull could save around $5,000 on her student loans.

This is not a singular case. This legislation could help alleviate tons of other students like Percifull.

“I mean right now we’re on a grid lock,†Nelson told Inweekly. “And it will depend on what the price tag is when I get this priced out by the congressional budget office.â€

He continued, “If the bill has a huge price tag then of course you have to argue the obvious justification, that these are the benefits to our society versus the cost to taxpayer’s money. But I suspect this bill is not going to be a tremendous cost.â€